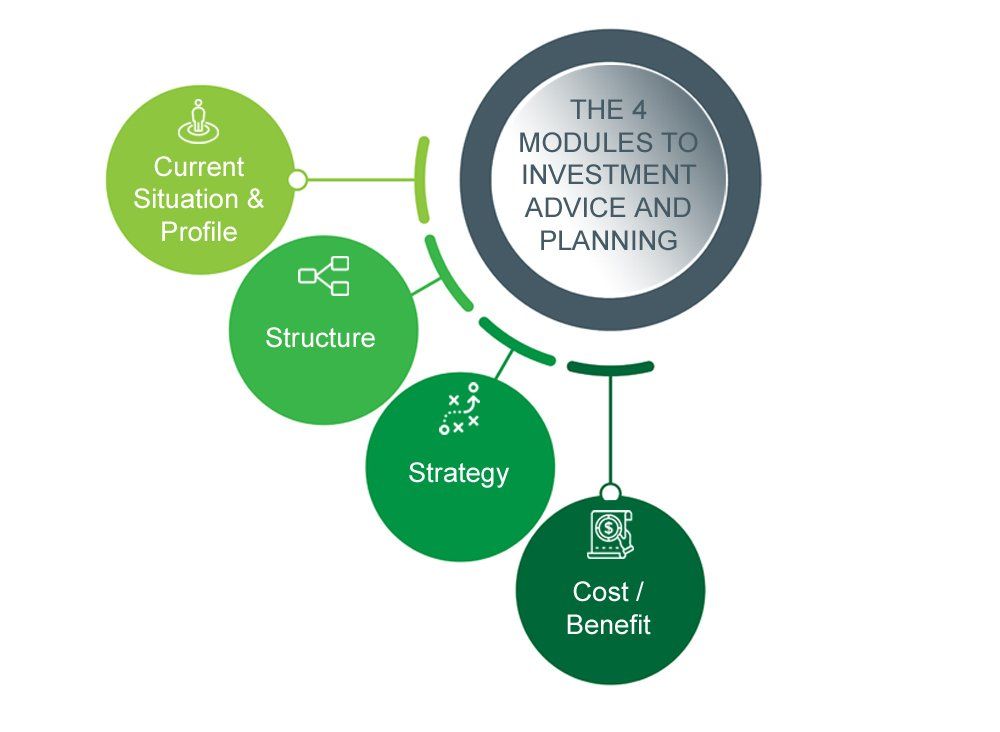

Module 2

Structure – This module represents the 3 foundations from which a client outlines their financial needs in the immediate term and forms the basis for ongoing periodic reviews that represent Module 4 “Cost / Benefit” when it comes to adjusting their financial plan for the medium and long term:

1. Cash

2. Income

3. Growth

Module 3

Strategy – This module outlines a strategy that is a variation on what is known as a “Core+Satellite” investing method. It utilizes a combination of investment time frames, and diversification by combining the various investment/ portfolio strategies utilized in mutual funds / unit trusts, ETFs, structured products and may include alternative investments. Module 1 “Current Situation & Profile” will provide the basis upon which the portfolio is constructed and the way this investing method is put in place. Tied closely to this process is managing a client’s expectations.

Module 4

Cost / Benefit – Change is a fact of life – one’s circumstances change, legislation changes, markets change and keeping up-to-date is an important element in the ongoing development of a strong client relationship and the maintenance of a robust business model. This module provides clarity on how financial professionals charge and what a client receives for the charges incurred:

1. Initial and on-going advice provided through regular periodic reviews of Modules 1, 2 and 3,

2. Consolidated monthly statements of investments with reports specific to the recommended investments,

3. legislative, Tax and Social Security monitoring,

4. investment opportunities and strategies,

5. Specific services – for executives, age pensioners and self-funded retires etc…

6. Client seminars and presentations by investment managers on relevant products and services,

7. Market and economic updates for clients and advisor,

8. Advisor regulatory updates on relevant government legislation, products, and services including required ongoing education.

In the articles to follow I will breakdown each module and outline the process each module covers.